By Henry Umoru & Gift Odekina

ABUJA — The Nigerian Bar Association, NBA, has called for suspension of the Tax Reform Acts over alleged alteration of some sections in the gazetted version, as opposed to what was passed by the National Assembly.

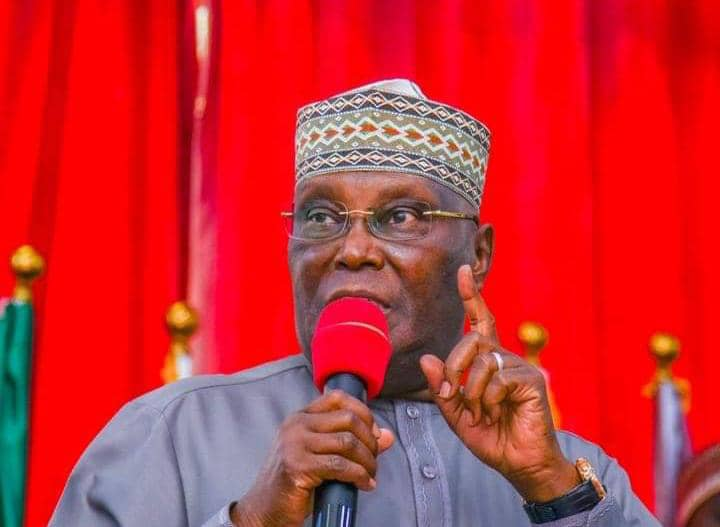

Former Vice-President Atiku Abubakar also called for the immediate suspension of the new tax laws over alleged alterations made after passage by the National Assembly just as he tasked the Economic and Financial Crimes Commission, EFCC, to investigate the “illegal and unauthorised alterations.

He said the alleged changes represent “a brazen act of treason against the Nigerian people and a direct assault on our constitutional democracy.”

Abubakar accused the executive of engaging in what he called a “draconian overreach” that undermines legislative supremacy and prioritises revenue extraction over citizens’ welfare.

This came as the two chambers of the National Assembly yesterday, ignored the alteration controversies trailing the tax reform acts, which implementation is scheduled to start on January 1, 2026, and proceeded on Christmas and New Year break that will end on January 27, 2026.

The lawmakers, however, approved the repeal and re-enactment of the 2024 and 2025 budgets. They also approved N43.561 trillion for 2024 and N48.316 trillion for 2025, and extended implementation period of the 2025 Appropriation Bill to March 31, 2026.

This was as the N58 trillion Appropriation Bill for 2026 entered second reading at the Senate.

Last week, a member of the House of Representatives Mr. Abdulsamad Dasuki, raised alarm over alleged differences between the tax laws passed by the National Assembly and the gazetted version.

Following the lawmaker’s disclosure, the NBA, in a statement, yesterday, said the development raises “grave concerns about the integrity, transparency, and credibility of Nigeria’s legislative process” and called for “a comprehensive, open, and transparent investigation be conducted to clarify the circumstances surrounding the enactment of the laws.

“Until these issues are fully examined and resolved, all plans for implementation of the Tax Reform Acts should be immediately suspended,” the NBA said in a statement by its president, Afam Osigwe.

Osigwe said the allegations “strike at the very heart of constitutional governance and call into question the procedural sanctity that must attend law-making in a democratic society.”

The NBA also cautioned that the controversy could have economic implications, noting that such “legal and policy uncertainty of this magnitude have far-reaching consequences.

“It unsettles the business environment, erodes investor confidence, and creates unpredictability for individuals, businesses, and institutions required to comply with the law.”

President Bola Tinubu signed the four tax reform bills in June, ending months of scrutiny and intense debates. The four bills, now laws, were the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

The Federal Government fixed January 1, 2026, for the implementation of the laws, but the move has stirred controversy in the country.

Opposition leaders and groups, including Peter Obi of the Labour Party, LP; the African Democratic Party, ADC, have asked the Federal Government to stop implementation of the law.

However, chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has defended the reforms and said the Federal Government was not introducing new laws.

The Federal Government argued these tax laws will transform Nigeria’s fiscal landscape, eliminate burdensome taxes, reduce tax compliance complexities, and foster domestic productivity, among others.

How Senate passed revised 2024, 2025 budgets

The Senate passed a revised N43.561 trillion 2024 Appropriation Act and a reworked 2025 budget framework, following passage of the Appropriation Act (Repeal and Re-enactment) Bills.

The approval was sequel to presentation and consideration of the report of the Committee on Appropriations chaired by Senator Olamilekan Adeola.

Following consideration at the Committee of Supply and plenary, the bills were put to a voice vote in the Senate. It was then read the third time and passed with senators describing it as a major step toward restoring fiscal discipline and budget clarity.

The exercise followed a letter transmitted to the National Assembly and read by Senate President Godswill Akpabio on Friday, December 19, 2025, conveying the request of the President for the repeal and re-enactment of aspects of the 2024 and 2025 Appropriation Acts, in line with constitutional and legislative budgetary procedures.

In his presentation, Senator Adeola, who explained that the core objective of the bills was to repeal earlier budget provisions and replace them with revised figures that reflect current fiscal realities, revenue constraints and emerging national priorities, said that the 2024 Appropriation Act was repealed from the original sum of N35.005 trillion and re-enacted with an aggregate expenditure of N43.561 trillion.

He said the breakdown of the revised figure, covering statutory transfers, debt servicing, recurrent and capital expenditure, was fully contained in the committee’s report.

On the 2025 fiscal year, Adeola explained that the earlier N54.99 trillion Appropriation Act was repealed and replaced with a revised total expenditure of N48.316 trillion.

Adeola, who noted that the adjustment reflected the rolling over of part of the 2025 capital expenditure into the 2026 fiscal year due to funding constraints, as outlined during the presidential budget presentation, stressed that the committee’s engagement with the economic management team informed the decision to repeal and re-enact the budgets, particularly to address concerns around revenue shortfalls, debt sustainability and effective implementation.

The lawmaker disclosed that an additional N8.5 trillion was injected into the capital component of the 2024 budget to accommodate special interventions in response to security, humanitarian and economic emergencies confronting the country.

According to him,the revised framework was designed to strike a balance between responsiveness and fiscal responsibility, ensuring that debt-related expenditures do not undermine legislative oversight or weaken fiscal prudence.

Explaining further, he said that in the 2025 budget, the committee observed that N6.674 trillion was removed from the capital allocation and deferred to the 2026 fiscal year, a move expected to enhance budget effectiveness in anticipation of improved revenue performance.

However, he warned against the continued practice of running multiple budget cycles concurrently, noting that extending implementation of one budget while another is already in force undermines fiscal discipline and budget transparency.

The committee recommended that the Senate approve the repeal and re-enactment of the 2024 Appropriation Act to authorise total expenditure of N43.5 trillion from the Consolidated Revenue Fund, as well as the revised N48.3 trillion framework for the 2025 fiscal year. The committee also recommended extending implementation of the 2025 budget to March 31, 2026.

In his remarks, Deputy Senate President, Senator Jibrin Barau, hailed the committee, describing the report as “top-notch,” praising its quality and the speed with which it was produced.

On his part, Chairman, Senate Committee on Finance, Senator Sani Musa, said that the revised budget captured critical infrastructure projects, including rail and road developments across several states, which he said were vital to national growth.

Also speaking, Chairman, Senate Committee on Banking, Insurance and other Financial Institutions, Senator Adetokunbo Abiru, explained that the reworked budgets will enhance fiscal discipline while preventing the loss of critical infrastructure spending due to overlapping projects and weak coordination.

On his part, the Chief Whip, Senator Tahir Monguno (APC, Borno North), stressed that passage of the bills will help end the distortion caused by running multiple budgets against a single revenue stream, describing the development as a welcome reform.

In his remarks, Akpabio described the approval as a “major transformative step” that will strengthen transparency and accountability in public finance.

Reps repeal, re-enact 2024, 2025 budgets

In like manner, in the House of Representatives, both bills were granted accelerated approvals at the Committee of Supply presided over by the Speaker, Dr. Tajudeen Abbas after presentation of reports by the chairman of the House Committee on Appropriation, Abubakar Kabir Abubakar.

With the passage of the Repeal and Reenactment bill(2),2024, the Accountant-General of the Federation shall “when authorised to do so by Warrants signed by the Minister charged with responsibility for finance, pay out of the Consolidated Revenue Fund of the Federation during the year ending on 31st day of December 2025, the sums specified by the warrants, not exceeding in the aggregate N43,561,041,744,507 trillion only, for the year ending on the 31st of December, 2025.”

Out of this amount, N1.743 trillion is for Statutory Transfers, N8.271 trillion is for debt service, N11.267 is for Recurrent (non-debt) expenditure, while the sum of N22.279 trillion is for capital expenditure/Development Fund contribution.

The N48.316 trillion Repeal and Reenactment Bill, 2025 is made up of N3.646 trillion for Statutory Transfers, N14.317 trillion for debt service, N13.588 trillion for Recurrent (non-debt) expenditure, while N16.765 trillion is for capital expenditure.

The Accountant-General of the Federation shall “when authorised to do so by Warrants signed by the Minister charged with responsibility for finance, pay out of the Consolidated Revenue Fund of the Federation during the year ending on 31st day of March 2026, the sums specified by the warrants, not exceeding in the aggregate N48,316,242,591, 785 trillion only, for the year ending on the 31st day of March, 2026,” the Reps approved.

The re-enacted 2024 budget has statutory transfers as follows: National Judicial Council, N341,625,739,236bn, NDDC, N338,924,732,832bn and UBEC, N263,043,551,250bn.

For the National Assembly, the National Assembly Office is allocated N36,727, 409,155bn, Senate, N49,144,916, 519bn, House of Representatives, N78,624,487,169bn, NASC, N12,325,901,366bn, Legislative aides, N20,388,339, 573bn, Senate Public Accounts Committee, N130m, House Public Accounts Committee, N150m, and general services, N30,807,475,470bn.

For the 2025 re-enacted budget, the NJC has N521.626 bn, NDDC N626.533bn, SEDC N140bn, NWDC N145bn, SWDC N140bn, SSDC N140bn, and NCDC N140bn.

UBEC has N496.842 bn, National Assembly N344.852bn, Public Complaints Commission N14.460bn, INEC N140bn, National Human Rights Commission N8bn, NWDC N240.998 bn, Basic Health Care Provision Fund N298.421 bn and National Agency for Science and Engineering Infrastructure (NASENI) N248.421bn.

2026 N58tn Bill passes second reading at Senate

Meanwhile, the N58,472, 628,944,759.00 appropriation Bill for the 2026 fiscal year presented before a Joint session of the National Assembly by President Bola Tinubu has scaled second reading in the Senate.

The proposed 2026 budget puts total expenditure at N58.472 trillion, made up of N4.097 trillion for statutory transfers, N15.909 trillion for debt service, N15.252 trillion for recurrent non-debt expenditure and N23.214 trillion for capital expenditure through the Development Fund.

President Tinubu had last Friday laid the 2026 Appropriations Bill before a joint session of the National Assembly for consideration and approval.

The resolution of the Senate followed its debate on the general principles of the 2026 Appropriations Bill during plenary.

Senators have, however, pledged rigorous legislative scrutiny to ensure transparency, fiscal discipline and tangible economic outcomes for Nigerians.

In his lead debate on the general principles of the 2026 money bill before approving it for second reading, Senate Leader, Opeyemi Bamidele, explained that the National Assembly bears a responsibility to align government spending with national priorities and aspirations of citizens, stressing that the credibility of the budget will ultimately be measured by its impact on the economy.

On sectoral allocations in the budget, Bamidele said that they were targeted at addressing Nigeria’s most pressing challenges. Security tops the priority list, based on the recognition that economic growth cannot thrive without peace and stability, adding, “security receives primacy, rightly so, because without peace and safety, no economy can thrive.”

Bamidele noted that the President’s commitment to a restructured national security architecture and a firm stance against terrorism, banditry, kidnapping and violent criminality,” informed share security got.

The Senate Leader described the budget as a continuation of ongoing economic reforms, framed as a “budget of consolidation” rather than experimentation.

He said the 2026 fiscal plan seeks to stabilise key economic indicators, consolidate earlier reforms and accelerate growth through targeted public investment.

Atiku calls for suspension of new tax laws

On his part, Atiku alleged that new provisions granting arrest powers, property seizure, and enforcement sales without court orders were inserted without legislative consent.

According to him, these measures “transform tax collectors into quasi-law enforcement agencies” and strip Nigerians of due process protections deliberately preserved by lawmakers.

Abubakar further claimed that additional changes increased the financial burden on citizens through mandatory security deposits, compound interest on tax debts, stricter reporting requirements, and foreign currency computation for petroleum operations.

The former vice-president also alleged that accountability mechanisms, including reporting obligations to the national assembly and ministerial oversight provisions, were removed from the laws.

He warned that stripping away oversight while expanding executive power is “a hallmark of authoritarian governance”.

Abubakar said the controversy exposes a government more focused on imposing tax burdens than on addressing poverty, unemployment, and rising inflation.

He also said that sustainable revenue generation comes from empowering citizens and expanding the tax base, not from “punitive taxation and erosion of legal protections.”

The post Gazette furore: NBA, Atiku seek suspension of tax laws appeared first on Vanguard News.